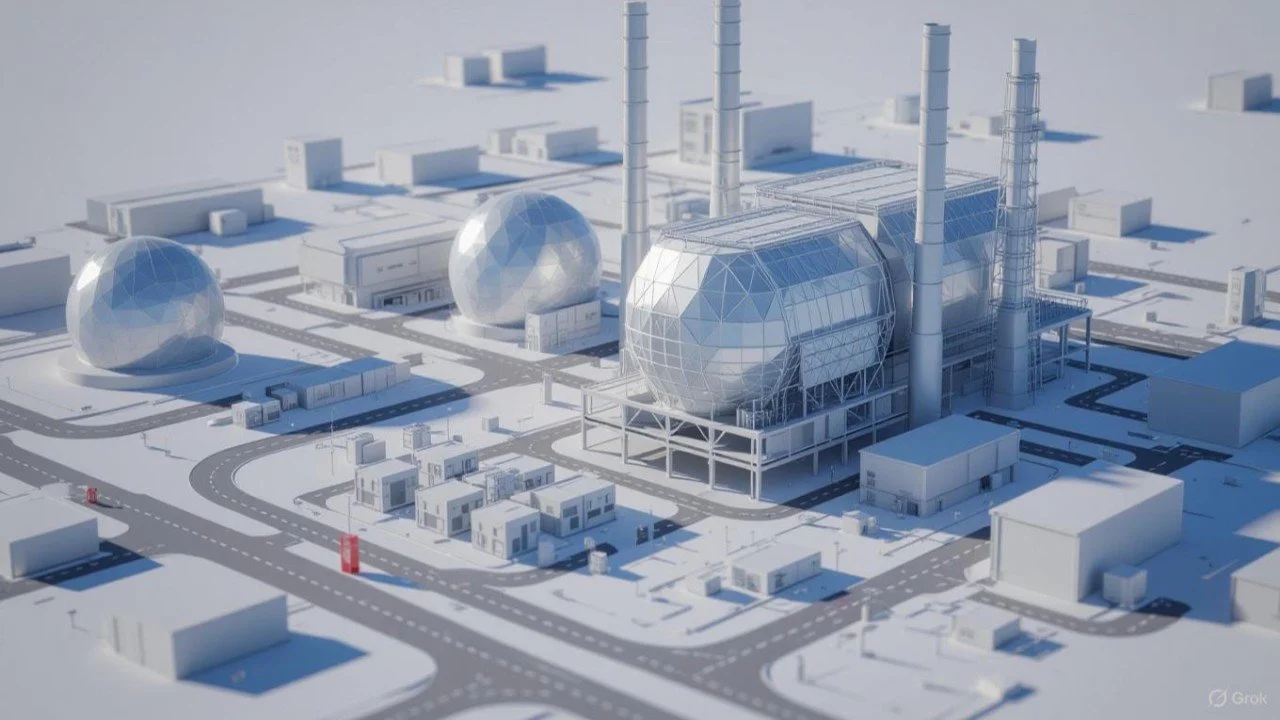

Open Architecture Nuclear Integration Framework

September 2025, LucidCatalyst

Standardized, modular approach to design and integration enables interoperability, scalability, and efficient deployment.

Excited to announce the release of LucidCatalyst's Open Architecture Nuclear Integration Framework white paper—the foundational research that drove The Open Group's launch of the Industrial Advanced Nuclear™ Consortium (IANC). Read on to explore how proven standardization principles are being applied to unlock nuclear energy's potential for industrial users.

Nuclear Heat and Power for Industrial Decarbonization

December 2023, Harvard Extension School

Industry is deemed a hard-to-abate sector due to its extensive, heterogeneous array of processes; GHG intensity; trade exposure; cost sensitivity; and long-lived facilities. While pathways for net-zero electric grids are being studied extensively, substantially less attention has been paid to industrial decarbonization. Nuclear technology holds vast and untapped potential to decarbonize the industrial sector. Advancements in nuclear technology, the modernization of the nuclear regulatory framework, public incentivization, and private investment are starting to unlock this technology to meet societal demands for sustainability. Establishing a detailed database of industrial cogeneration facilities and conducting systematic analyses of nuclear cogeneration generates insights on the potential pathways for this technology.

The Untold Financial Story of Nuclear Power

December 2023, Going Nuclear with Osama Baig

During Climate Week NYC we discussed financing strategies for nuclear power projects across the world, covering topics like green bonds, cost sharing for large nuclear projects and how countries across the world can develop sustainable financial models for new nuclear.

Nuclear Cogeneration for Industrial Decarbonization

Join the Climate Solutions Symposium (hybrid) Saturday, October 7th 1 - 5:30pm CDT organized by Engineering Science & Technology Council Houston, where Isuru will present on nuclear heat and power for industrial decarbonization.

Nuclear Energy for Sri Lanka’s Decarbonized Future: A Sustainable Alternative to Liquefied Natural Gas Dependence

August 2023, Brandeis' Center for Global Development and Sustainability

Greenhouse Gas Inventory and Mitigation Pathways 2023

May 2023, First Unitarian Universalist Congregation in Brooklyn

This report presents First Unitarian’s inaugural Greenhouse Gas inventory and prior`itizes mitigation pathways. It is a derivative of research Isuru conducted for Harvard Extension School’s The Carbon Economy: Calculating, Managing, and Reducing Greenhouse Gas Emissions with Richard Goode & Marlon Banta, in partial fulfillment of a Master of Liberal Arts (ALM) degree.

ELECTRIC EVOLUTION: New York's Electricity System, Prices, and Climate Plans

November 2022, Harvard Center for Geographic Analysis

An exploration of New York’s electricity market, people, and nature questions how to decarbonize the fossil-heavy New York City region. Isuru conducted this research for Harvard Extension School’s Introduction to GIS with Jeff Blossom, in partial fulfillment of a Master of Liberal Arts (ALM) degree.

Co-authored by Nuclear New York, Clean Energy Jobs Coalition-New York, and a Campaign for a Green Nuclear Deal, and a foreword by Prof. Joshua S. Goldstein, Professor Emeritus of International Relations of the American University and Dr. James E. Hansen, Climate Scientist of the Columbia University Earth Institute, this policy brief calls for nuclear energy to be the foundation of New York’s carbon-free grid. Recognizing that an abundant, affordable, reliable, and resilient electric grid is the backbone of every prosperous modern society, Bright Future highlights how nuclear energy provides high-quality, inter-generational jobs that underwrite vibrant and healthy communities, protects New York’s forests and farmlands from energy sprawl, and paves the way for robust in-state low-carbon energy and manufacturing supply chains.

Nuclear has the highest unionization rate and highest wages across the electricity generation sectors.

Setting the Record Straight on Indian Point

February 2021

A critique of the Physicians, Scientists, and Engineers research brief ‘Evaluating the potential for renewables, storage, and energy efficiency to offset retiring nuclear power generation in New York,’ co-authored with Dr. James E. Hansen and others

In 2019, nuclear power comprised a third of total electricity generation in New York and was responsible for over half of carbon-free electricity statewide. Indian Point generated 2.5x the carbon-free energy of all solar panels and wind turbines deployed statewide. Due to Indian Point’s premature closure, the regional electric grid is almost exclusively powered by fossil fuels since April 2021.

Carbon Dividends 2020

November 2020

Carbon Dividends overcomes the “Tragedy of the Climate Commons” via a corrective feedback loop. It aligns the economic incentives of ordinary Americans and businesses with that of the planet.

NEW YORK’s FRACKING BAN AND ITS DISCONTENTS

April 2020

Although New York banned fracture stimulation for petroleum extraction, the state’s gas consumption, which had been growing robustly, is about to go into overdrive due to the voluntary closure of the largest source of carbon-free electricity.

Evergreen Energy: a mighty nature-based solution

January 2020, LinkedIn

Sri Lanka has been a pioneer in integrating evergreen agriculture with bio-energy generation. This is a is a unique and massively scalable solution for reducing emissions with many ecological and rural empowerment co-benefits. This overview considers the ecological, economic, and climate benefits of Gliricidia-based electricity generation projects.

Sustainable Investment Practice

December 2019, LinkedIn

Reflections on how to develop sustainability in investment practice along impact investing, proxy voting, and shareholder engagement for capital allocators.

COAL, Carbon, and Life

December 2019, Energy Central

Coal-based electricity is beneficial to its consumers, despite the dire implications for global warming. Those who use more coal-based electricity have no moral standing to deny the same for others. Thus advocacy should focus on high coal consuming nations rather than the energy-poor ones.

Québec Hydropower for New York's Clean Energy?

August 2019, Energy Central

New York has mandated the most ambitious climate policy in the U.S., including a carbon-free electricity system by 2040. In order to meet the deep decarbonization goals of natural gas-powered downstate New York is looking to bring hydropower from Québec. I evaluate this policy from a global warming perspective using the life-cycle impact of competing electricity generation technologies.

Podcast: Bipartisan Climate Action, and Being an Engaged Citizen

February 2019, Energy Vista

Energy Vista is a podcast on energy issues with Leslie Palti-Guzman. This episode she and Isuru talk about pragmatic solutions to global warming. Isuru addresses what climate action means at the policy and investment levels (e.g. Energy Innovation and Carbon Dividend Act, carbon tax, Green New Deal, green investment, divestment).

U.S. Shale in the World Oil Market

December 2018, LinkedIn

U.S. shale growth is upending the geopolitical stability in oil markets, and will create a massive amount of work for domestic oilfield service providers.

Carbon Dividends:

The breakthrough climate solution

October 2018, Radiant Value

Politicians of all stripes, students, businesses, and environmentalists are supporting a carbon dividend plan to break the deadlock. With 81% of American voters wanting action on carbon emissions, carbon dividends plan is a rare opportunity where the partisan barrier can be overcome.

The Climate Impact of Energy Storage

June 2018, PDF Download

Investing is growing exponentially worldwide as more funds focus on this niche. Energy storage enables virtually all other ‘green’ technologies and helps realize decades of environmental investing.

Electric Mobility-as-a-Service & Peak Oil Demand

August 2017

Three nascent transformations taking place in passenger transportation – on-demand ride sharing, electric vehicles and autonomous automobiles. These will have profound implications on commodities like oil and specialty chemicals like lithium. Here we dig into the fundamentals to quantify and envision the impacts.

The Original Sin And a Pathway to Carbon Redemption

April 2017

In the religion of climate environmentalism, carbon is the new ‘Original Sin.’ While solutions that enable equitable energy access while decarbonizing the energy mix already exist, the debate on who should pay has stymied global accords. In the first Republican acknowledgement of the problem, the Climate Leadership Council proposes each nation tax CO2 when emitting resources enter the economy – at mines, refineries and ports – and all proceeds returned to its citizens. A market-based tax-and-dividend program ticks the Trump boxes of promoting high-paying American jobs, is pro-business, includes a border tax and limits government.

WHEN SALT IS WORTH MORE THAN GOLD

November 2016

Growth in portable electronic devices, electric vehicles and renewable electricity generation has elevated lithium from a niche industrial chemical to an element vital to the future of energy. SupplBreaking Point: Capitalizing an Oil Glut, and its Consequencesy shortfalls have driven prices up, but like 'salt on a salad,' lithium accounts for only 3–8% of battery cost. An increasing portion of world supply comes from high-cost hard-rock mines, rather than the brine reservoirs of Latin America.

Uranium: Electrifying the Low-Carbon Future (Part 2 Demand)

June 2016, Harvest

Nuclear power hit a hard reset with the Fukushima Daiichi disaster in March 2011. The downturn in nuclear has been deeper and longer than that of oil and gas, allowing for more supply destruction to play out (See Part 1 of this series). However, more nuclear reactors are presently in the development pipeline than ever before. Investments to address the greenhouse gas effects of the world’s growing energy needs are accelerating. Steady and zero-emission nuclear power will be a key part of the solution.

Uranium: Electrifying the Low-Carbon Future (Part 1 Supply)

June 2016, Harvest

Present uranium prices are materially below the marginal cost of production. Enduring low prices have set in motion a future supply deficit for uranium. A similar crunch occurred in the 2000s following a 20-year bear market. Spot uranium prices bottomed at $7/lb in 1997 when production costs were $20/lb. As prices rose, supply security concerns drove utilities to compete for contracts. Prices skyrocketed to $138/lb by 2007. During this period, companies that owned quality resources, permits and production, operated by value-creating management, had their shares multiply ten- to thousand-fold from forgotten ‘penny stock’ levels.